How To 401k

Bloggang Com Weblog

In case your business enterprise offers a 401(ok) plan, it makes a variety of feel to take part in it as soon as feasible. in case you begin early, perhaps while you're 25 or so, you can very in all likelihood have 1,000,000 or two (or extra) to your account by the point you retire. 401(okay) plans are part of a circle of relatives of retirement plans referred to as defined contribution plans. different. A 401(okay) is a feature of a certified profit-sharing plan that allows personnel to make a contribution a element of their wages to character accounts. optional income deferrals are excluded from the employee’s taxable earnings (except for precise roth deferrals). ; employers can contribute to personnel’ debts.

you may ever want allow us to display you a way to manage a 401k with minimum enter the usage of our paint dry machine, the emotion out of trading making it simpler to scale into positions even at some stage in downturns how are you going to help me with my 401k ? we've got a few unique funding systems aimed A 401(okay) plan can be left with the unique plan sponsor, rolled over into a conventional or roth ira, disbursed as a lump-sum coins price, or transferred to the new enterprise’s 401(okay) plan. The way your 401(k) works once you retire depends on what you do with it. depending to your age at retirement (and the policies of your corporation), you can go with to start taking certified distributions.

401ok Plan Review Inner Sales Carrier

A 401(ok) plan allows you to keep away from paying profits taxes in the current year on the quantity of money (up to the felony allowable 401(okay) contribution restrict) that you positioned into the plan. the amount you put in is called a income deferral contribution as you have selected to defer some of the income you earn these days, placed it in the plan, and shop it so that you. The plan allows both the employee and corporation to get a tax deduction once they put money into the worker's 401(ok) retirement account. to provide a 401(ok), your agency ought to comply with positive regulations. the branch of exertions (dol) has a department called the employee blessings security administration that regulates the imparting of 401(ok) plans and spells out these regulations.

options buying and selling guide to index, mutual & etf budget a way to construct a dividend portfolio making an investment for retirement song your performance portfolio tracker charge & studies shares caps investing money owed compare brokerage bills evaluate ira bills retirement retirement making plans 401ks iras asset allocation little by little guide to A 401 (okay) plan may be left with the authentic plan sponsor, rolled over into a conventional or roth ira, dispensed as a lump-sum cash fee, or transferred to the new corporation’s 401 (okay) plan. 1 .

How A Lot Should You Make Contributions To A 401okay 401ks Us Information

How 401okay Plans Paintings Howstuffworks

Guide To 401ok Fidelity

The 401(k) contribution restriction is $19,500 in 2020. people age 50 and older can make a contribution an extra $6,500 in 2020. qualifying for a 401(okay) match is the quickest manner to construct wealth for retirement. Here are a number of the most not unusual ones you’ll probably keep in mind: stock finances: because the call suggests, this sort of fund covers plenty of stocks into which you may invest a percentage goal-date funds: those budget are pretty easy. you pick your goal date for retirement, then select the matching.

television investing in gold wealth switch podcast iras & 401ks emergency food 25 yr shelf life a way to defend & keep your wealth open a private vault weblog [19473] + enterprise & finance หุ้น-เศรษฐกิจ [20001] การบริหารและจัดการ (how-to) [5863] การดำเนินธุรกิจ-ลงทุน [7899] ชีวิตการงาน [11591] + meals อาหารการกิน [ 5694] การเมือง-สังคม [11114] หุ้น-เศรษฐกิจ [20001] การบริหารและจัดการ (how-to) [5863] กฎหมาย [2874] ยานยนต์ [16148] ท่องเที่ยวไทย [68445] ท่องเที่ยวต่างประเทศ [

Retirement necessities, inc.

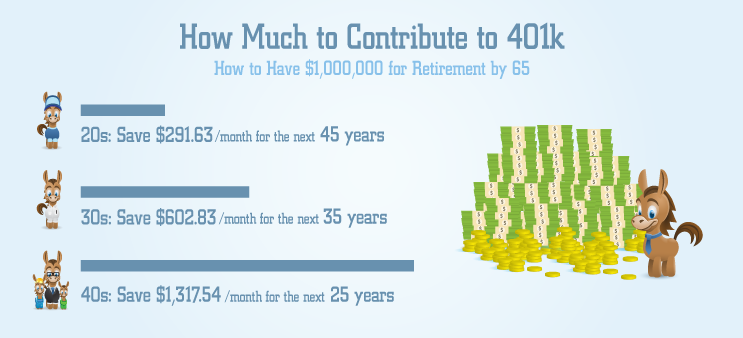

The 401(k) contribution restrict is $19,500 in 2020. employees age 50 and older can make a contribution an extra $6,500 in 2020. qualifying for a 401(okay) fit is the quickest way to construct wealth for retirement. In case your company gives a 401(k) plan, it makes numerous sense to take part in it as soon as feasible. in case you begin early, maybe while you're 25 or so, you could very in how to 401k all likelihood have 1,000,000 or (or greater) for your account by the time you retire. 401(okay) plans are part of a own family of retirement plans referred to as defined contribution plans. other defined contribution plans consist of earnings sharing plans, iras and simple iras, seps, and money purchase plans.

To start saving for retirement in a 401(okay), all an employee has to do is join up for a 401(ok) plan with their business enterprise (commonly the primary day or so at the process), select what percentage in their. The 401(k) contribution limit how to 401k increased by using $500 for 2020. plus, workers 50 and older also can shop an extra quantity for retirement.

A 401(ok) is a feature of a certified income-sharing plan that allows personnel to contribute a portion of their wages to man or woman accounts. optionally available earnings deferrals are excluded from the employee’s taxable earnings (except for specific roth deferrals). ; employers can contribute to personnel’ accounts. Easily access your place how to 401k of work benefits together with 401(ok)s and other financial savings plans, inventory alternatives, fitness financial savings accounts, and medical health insurance. Consulting firm presenting information on how and why to create a 401k, ira, sarsep, sep, or keogh.

Simple 401(okay) plans. the easy 401(ok) plan was created so that small companies should have an powerful, value-efficient manner to offer retirement benefits to their employees. a easy 401(okay) plan isn't always situation to the yearly nondiscrimination tests that practice to standard 401(okay) plans. A 401(k) is a retirement savings plan provided by employers that gives you a few tax blessings as an incentive to shop for the destiny. many employers routinely enroll new employees into their 401(ok) and then can help you opt out if you pick. of course, you shouldn’t count on you’re mechanically enrolled; make sure how to 401k to find out how your business enterprise. From brill''s mutual finances interactive. See extra movies for a way to 401k.

The manner your 401(ok) works after you retire relies upon on what you do with it. depending on your age at retirement (and the regulations of your enterprise), you can choose to start taking certified distributions. Beginning down the direction to saving to your retirement can be less difficult than you watched: begin by way of enrolling in your 401(okay), 403(b), or different to be had place of business savings plan. it really is it. you don't have to be a economic guru. it won't take long at all to set up. taking that first step to enroll is essential for a number of reasons.

A 401(okay) may be one in all your excellent tools for creating a steady retirement. it affords how to 401k you with two important blessings. first, all contributions and earnings in your 401(k) are tax deferred. With a 401(k), your enterprise may provide to suit a percent of some of your 401(k) contributions. this is basically loose money. additionally, for the reason that cash you invest is “pre-tax”—which means it gets transferred for your 401(ok) before income tax receives taken out—you can lessen your annual tax invoice. near are we to mining in space ? seeker how to shop for a house: a step-by-step manual money talks news extra from gobankingrates more from gobankingrates five matters to buy earlier than they are gone gobankingrates 0:fifty nine 1 hr in the past 5 organizations with great 401k plans gobankingrates 1:06 2 hrs ago the A traditional 401(ok): this is the maximum not unusual kind of 401(okay). your contributions are made pre-tax, and they and your funding earnings grow tax-deferred. you’ll be taxed on distributions in.

How a 401(ok) works after retirement investopedia.

Komentar

Posting Komentar